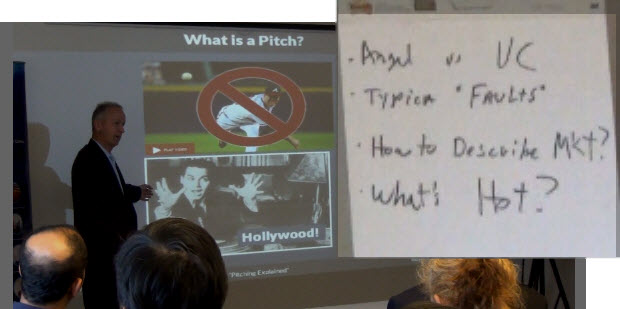

Here are the questions from last week’s workshop that we still need to address directly.

- Difference pitching to angels or VCs?

- Typical Faults in the pitch

- How to describe the market and the competition

- What’s hot (What investors are most interested in)

Do Angels and VCs need different pitches? No. But the style and formality will probably vary a lot. Keep in mind both kinds of investors need the same information in order to justify their risk of investment. But the stakes are higher in absolute money terms for the VC. The angel, risking smaller sums may decide to “make a bet” more quickly on less information. Because, afterall, at the angel stage you have accomplished and proven less. I believe an angel pitch will probably rely more on claiming a high value potential in your unique solution and talents. Those things you will have at early stage. For the VC, they will expect further validation of your market potential, competition, go-to-market, etc. These are two variations of the same pitch just optimized for the audience and data you have at hand.

Typical Faults in the Pitch. This is just review of the workshop. 1) Structure is muddy. Follow format of Problem, Solution, Market, Business model. 2) No Bear: make sure your problem description includes impactful detail and emotion about the seriousness of the problem and the number of people seeking a solution. 3) Tell a story of discovery or a story of “proof” of the validity and appeal of the solution.

How to describe market and competition? Start with a review of MBA style materials on line or on your bookshelf. Markets are described first in terms of dollars. The size of a real or hypothetical market ia annual dollars spent. Then there are fancy ways to further detail using terms TAM, SAM, etc. Thing is, many startups are looking to CREATE new markets or extend established markets in disruptive ways. What then? I have seen no fixed rules except numbers and logic. You should compare your “new” market with similar markets for similar people seeking to solve similar problems. Then you can make a whole serious of logical steps to justify your market claim. Keep the steps as few as possible, the logic tight and the numbers easily findable on Google, etc. You will be challenged to justify your claims! Get the market claims in your pitch reviewed and critiqued by an expert in your segment. Please! Another helpful “starting out” resource from an Oregon incubator

What’s Hot (what are investors currently interested in)? This is a bit like asking what kind of movie Hollywood wants to make next year. They want to make a winner! In Hollywood being a copycat is more convincing than being a copycat in silicon valley. Every enterprise must have a unique value and positioning to succeed. Now the hot buzzwords are certainly still big data, the cloud, customer facing architecture, mobile apps, social networks for special interests and the internet of things. But what will sell is your unique proposition and you’ll have to have passion behind it. So this question is not so useful unless you can get your passion adjusted to match the buzzwords. Paul Graham’s advice, “Just make life better for people”

Roy